Zero to One

Zero to One - Notes on Startups, or How to Build the Future is a book based on the lectures of Peter Theil and the notes of Blake Masters. The original notes are legendarily meticulous, and the book is itself a curated and refactored collection of those notes.

Peter Theil

Peter Theil is a fascinating figure; a contrarian, “the bad boy of Silicon Valley”, “the philosopher VC”, Theil has quite the notoriety. From supporting Donald Trump to the lawsuit against Gawker media, Theil has earned the ire of most of left-leaning Silicon Valley. Despite all of this, Theil has remained something of a cult figure, especially among the more conservative minded. I wasn’t all too sympathetic towards Theil and his views but after reading this book I am approaching my attitudes towards him from an entirely different angle. While I still don’t agree with much of what he says, he clearly knows a thing or two about entrepreneurship and start-ups.

This book is not a step by step guide for creating a start-up when compared to titles such as “the Lean Startup” or “the Startup Owners Manual”, but it is a unique view into the minds of one of Silicon Valley’s most intriguing people. I’ll discuss the most insightful and in-depth chapters.

Party Like It’s 1999

Peter Theil along with Elon Musk and “the PayPal mafia” sold their company PayPal right before the 2001 dot-com bust. Going from maniac exuberance back to reality caused the companies of the time to learn a few lessons about business and technology. They were to:

- Make Incremental Advances

- Stay Lean and Flexible

- Improve on the competition

- Focus on product, not sales

Theil argues that all of these ideas are mistaken, and will just lead to mediocrity. I personally was on board with those suggestions until Theil made his argument for an alternative and contrarian version of the list which he contends will lead a company to much greater success. Theil claims:

- It is better to risk boldness than triviality

- A bad plan is better than no plan

- Competitive markets destroy profits

- Sales matters just as much as product

I was talking to a friend about this and he seemed to be skeptical of most of these points. Perhaps a really bad plan can be worse than no plan. Competition breeds improvement. If you don’t focus on your product you won’t get sales.

To these I’d probably say:

-

It’s rare to be able to plan so badly that no plan is superior. A plan would at the very least improve your business and move it in a particular direction whereas no plan would improve you nowhere in particular. It’s not the difference between a specialist and generalist, it’s more like the difference between having goals and messing around.

-

A competitive market is good for consumers in that you get the cheapest prices, but R&D cannot be done without profits. Improvements can’t be made without investment. Ultimately you want companies to spend a lot on R&D so that you can have better products over time, not just the cheapest products right now.

-

You need both sales and product but some people will buy a bad product if the sales strategy is great. If you have the greatest product in the world but nobody knows about it, it’s irrelevant.

I would say however that these two lists aren’t mutually exclusive, all of the points must be judged by the specific context in which they take place. Some companies really have a bad product and great sales, so they should actually focus on product. Some companies are too rigid and overly planned, not responding to consumer demand and market changes. Any list that claims to have the be all, end all truth is wrongheaded at best.

You have to find your place within these dichotomies:

Incrementalism vs. Boldness

Leanness vs. Planning

Competition vs. Monopolization

Product vs. Sales

You Are Not a Lottery Ticket

Theil starts the chapter criticizing the hyper-successful who ascribe their considerable wealth and success to pure luck or being in the right place at the right time. He notably brings up the fact that there are people who have created multiple billion - dollar companies which seems to fly in the face of the idea that every huge company is a lucky one hit wonder.

Most entrepreneurs seem to reject this framing. Almost every guest on podcasts such as “How I Built This” say that their success is mostly luck based and being in the right place at the right time. The book quotes Bill Gates, Jeff Bezos and the like talking about their abundant luck. Theil thinks that this is a sort of strategic modesty. I think it’s not only that, but also that people may not realize how weird they really are. Oftentimes when narrating their journey, great entrepreneurs seem to get into situations which a normal person wouldn’t, or take risks that a normal person wouldn’t.

In addition to that, they all seem to work inhumanly hard and are extremely intelligent. Michael Dell talked about making hundreds of thousands in sales out of a dorm room basically, but unlike a typical college student who would be incredibly satisfied with that, he continued pushing and trying to compete with bigger and bigger companies. Can you imagine many undergrads deciding to work harder after casually getting $600,000 in sales from their dorm room business?

Jim Koch of Samuel Adams quit his lucrative consulting job at BCG to start a company in a seemingly dead industry. American beer went from being a joke to probably the best in the world when it comes to craft beer. The founders of Airbnb created hugely successful presidential election cereal on a whim. These aren’t the actions or achievements of normal people. Obviously, the market conditions and lifestyles of all these entrepreneurs was perfect for what they wanted to do, but that’s discounting their own very real talent of being able to take advantage of those opportunities at all.

Moving past the discussion of luck, the book takes a philosophical turn into a discussion of free will and our loci of control. Theil argues that instead of thinking of yourself as a lottery ticket and just hoping that you are the one in a million who will create something transcendent, you actually have to believe it and go try to make it happen. Far too often people are fatalistic when it comes to their own success; they hear Bill Gates say that he was just lucky, and they hope they get lucky too.

I reached a similar conclusion on my own; whether or not we ultimately live in a predetermined universe is irrelevant; acting as if you don’t will make you much more successful in your endeavors.

The philosopher Daniel Dennett brought this up in one of his talks (5:30): which would you prefer to have as an army (assuming equal training and equipment); 1000 fundamentalists who are willing to die for this battle, or 1000 economists looking over their life insurance policies? Even if the economists have a more accurate worldview, they still wouldn’t be as successful as the fundamentalists. Dan goes on further to say that the fundamentalists pay the hidden cost of dishonesty, but we don’t have to in our case, we can accept our evidence backed (or not!) beliefs of reality while living life a different way. Effectively we can have our cake and eat it too. This hints at a more complicated problem, however; how do you know if you are the lone genius or the lone lunatic?

I think that ultimately you can’t know. A true lunatic will never know that they are a lunatic, and this is why it will always be safer not to go down the uncharted road. However, if nobody ever took such a risk where would we be? Even if you don’t ultimately believe it, living your life as if you have 100% control over everything that happens, and you’ll make a much bigger impact on your circumstances than you may think. Just think about it: being screwed over by a person who has power over you may be something that seemed completely out of your control, but if you live your life as if you could’ve prevented it, then in the future you’ll be able to identify the superiors who would do you harm, and find a way to lessen or neutralize their influence over you. Making an effort in that direction, where there was none before can have incredibly positive impacts that you never would’ve known had you just given up.

Optimism vs. Pessimism and Planning vs. Hope

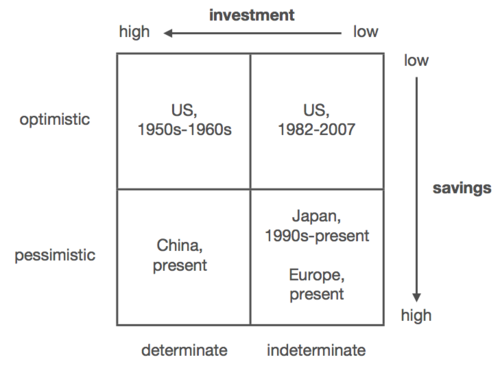

In the same chapter, an interesting concept introduced by Theil was the idea of the 4 quadrants of definite optimism, indefinite optimism, definite pessimism, and indefinite pessimism. This was a very stars and stripesy section but it brought up some interesting ideas.

Indefinite Optimism

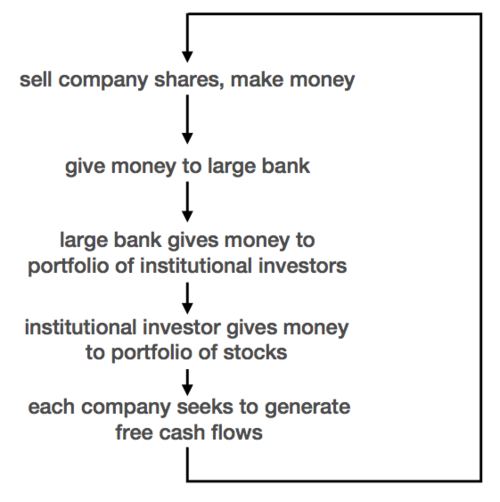

Theil writes that the USA is currently in an indefinite optimistic mindset: we believe the world will be better in the future, we just don’t know how. We aren’t going to make specific steps towards it either; we’ll just sit and watch. There’s a cycle of finance in this indefinitely optimistic country which goes like this:

Nothing is really happening. It’s just a self-sustaining cycle where nobody is brave enough to make an actual investment in anything or anyone. We just live with the assumption that someone else will do it. People hold onto government bonds and savings even while they have a lower or equal expected return than the inflation rate. People are allowing their money to slowly rot away rather than actually investing it in anything. This seems absurd.

Even the “innovative” companies like Google and Apple are just sitting on piles of cash in offshore accounts, and letting them rot. They’re too scared to put that money into an actual venture and are content with just losing it slowly. The United States at this moment seems to be a bunch of risk managers, nothing more.

Indefinite Pessimism

Europe, on the other hand, is pessimistic about the future; it’s in decline, but won’t take any definitive steps to stop it. Once again, they’ll just sit and watch.

Definite Pessimism

China, Theil argues, is a pessimistic society but with defined plans. They know they can copy the Western model to great success and will continuously copy until they catch up. Theil writes “Every other country is afraid that China is going to take over the world; China is the only country afraid that it won’t.”

What’s interesting is Japan’s place in this. Theil said that Japan used to occupy this position; they relentlessly copied the United States in every facet. Japan took denim, technology, manufacturing from the USA and the West. Now, however, Japan seems completely uninterested in the USA. Japanese denim is the best in the world. Japanese technology is very different than American, same with cars, programming, and television. Golf used to be hugely popular in the 80s in Japan, now the golf courses are being turned into solar farms. Theil thinks that this is a disturbing sign of the stagnation of the West. We used to think that it was OK for Japan to copy us because while they were busy copying, we’d be moving on to the next thing. Now, however, they’ve caught up, and they’ve found nothing more that we provide. The Western world is no longer far ahead.

Definite Optimism

Theil reminisces for the USA of the 50s and 60s. John F. Kennedy said that we would reach the moon in 10 years, and we did it. People made huge, ambitious, audacious plans and then went out and tried to complete them. Nowadays we’ll have experts saying that everything is impossible or infeasible. The thing is; the experts are right 99% of the time; that’s why they’re experts. This is the problem with our society though; if we only do the feasible we’ll never do anything truly great or amazing. Greatness comes from doing what’s unthinkable, not what we say “yeah we should do that next” to.

Theil wants us to forget finance and focus on engineering. Forget savings and focus on investment. The greatest companies are built by great engineers and sales people (more on this in the next section) not CFOs and accountants.

If You Build It, Will They Come?

Engineers have always seemed to have the upper hand in the “who is more useful” debate. After all, what’s a sales person with nothing to sell? This chapter really dives into the false security engineers have in “product” over everything.

The bottom line is; a product that sells itself is a fantasy.

This is definitely a lesson for a lot of professionals. The lawyer that gets paid the most in the firm isn’t the best lawyer in the courthouse; he’s the rainmaker out there getting clients for the firm. The richest businessmen aren’t the CTOs, they’re the CEOs. The most powerful political actors aren’t policy geniuses, they’re political geniuses. In order to do anything; the “engineering” is expected, the sales is where the greatness comes in. Nikola Tesla was probably a much better engineer and inventor than Thomas Edison, yet he’s not nearly as well known (before Elon Musk’s Tesla that is), and he wasn’t remembered like Edison was. This is the prototypical case of the pure engineer against the 1/2 engineer, 1/2 salesman.

Conclusion

There is much more to get into with this book, from the similarities between the Unabomber and hipsters to secrets and philosophy. Perhaps I’ll get into it in another blog post. What I’ve written above however are what I found to be the most seminal points. This wasn’t a start-up manual, it was a historical and philosophical look into the mind of one of Silicon Valley’s most interesting people. The breadth of topics covered was as wide as the perspectives unique. I suggest you give it a read.